The pharmaceutical industry is a very stable and important industry. In latest reports – consolidated health expenditure is set to rise by 8.3% over the medium-term expenditure framework, making it the fastest growing category of government spending after debt servicing and post-school education. Health expenditure will grow from R170.9bn in 2016-2017 to R187.5bn in 2017-2018, and then rise to R201.4bn in 2018-2019 and R217.1bn in the outer year – budget 2017. The average South African consumer spends approximately 1,9% of their total household expenditure on medical and pharmaceutical products (Macquarie Research, May 2011). The pharmaceutical industry is also a very competitive industry with leading pharmacies dominating the market, for this reason pharmacies need to be on-top of their game and constantly re-invent themselves to remain competitive. This is where pharma 1.0, 2.0 and 3.0 emerged.

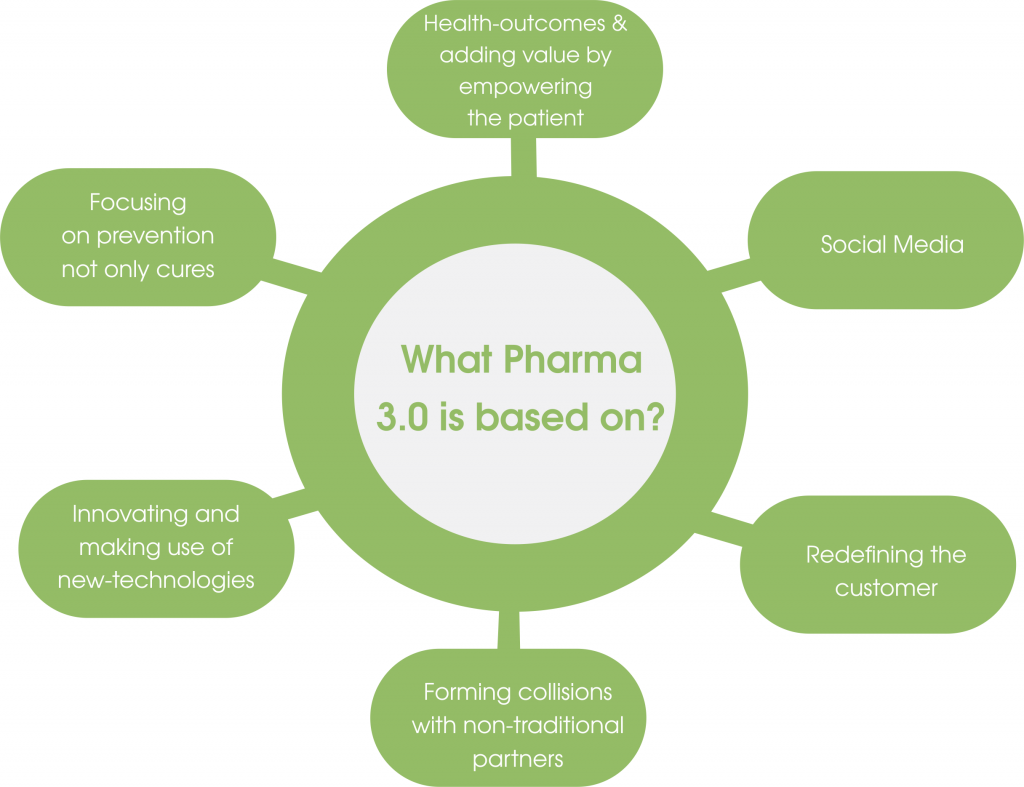

To bring a pharmaceutical drug to market is not something for the faint-hearted. There are strict regulations that need to be complied with. The length of time taken to bring a drug to a point where it can be sold can be up to eight and a half years, or longer. And the cost can add up to more than US$800 million. As a result, pharmaceutical companies rely on a “blockbuster” drug. Which is one that alleviates, or cures, specific problems, and for which there is a high demand. This is what defines “Pharma 1.0” – the age of the “Blockbuster”. However, Pharma companies also realized that there is more than just having a “really great product”. “Pharma 2.0” is a period where there was a recalibration to do business leaner, nimbler and more focused on emerging realities. Effectively, the focus was on redefining the business model. Most pharmaceutical companies are in the 2.0 phase, but “Pharma 3.0” has started to emerge. Pharma 3.0 can be described loosely as “Pharma + Web 2.0”. Pharma 3.0 is a reconfiguration of the model with a focus on health outcomes where the traditional product, the drug – is only one part of pharma’s value proposition. Pharmaceutical companies need to be more innovative, collaborative, diversified, global and value-driven.

What Pharma 3.0 is based on?

Health-outcomes

A common theme is creating a more efficient system by focusing on health outcomes. Health information technology is further enabling and accelerating an outcomes-driven industry. The digitalization of health data, electronic health records and associated e-Health platforms offers the promise of enhancing efficiency, increasing safety and reducing costs. Mobile health technologies provide live and real-time access to digital health information, supporting diagnosis and monitoring, as well as driving compliance in medication.

Delivering on health outcomes will require the pharma industry to engage in the cycle of care around the patient, from predisposition testing, prevention, diagnosis and therapy to patient monitoring. In the Pharma 3.0 business model, pharma companies seeking to deliver health status improvements need to reach new patients by tackling underserved markets, meet unmet medical needs and do a better job of serving existing patients by managing patient outcomes.

“Pharma 3.0” is about adding value by empowering the patient

And it’s something that the pharma companies are all involved with (in one way, or another). Examples include smartphone apps that provide information on the medication that a patient is taking, allowing two-way communication between patient and pharma company, forming groups/networks of patients using the same medication or suffering from the same ailment, apps that give patients easy ways to record treatments and keep track of the symptoms they experience.

The impact of social media on the health industry

Social media plays a big role in Pharma 3.0. The advent of social media has brought a voice to the end consumer. With a greater wealth of knowledge at their hands, the patient has become more knowledgeable about their ailments, and more critical of the medicines they are taking. Patients are more empowered to improve their health, as they can access information that was previously only available to healthcare providers. Social media platforms are enabling patients to share health information within their networks and communities.

Redefying who the customer is

Pharma 3.0 requires you to redefine who the customer is. No longer is the customer only the medical doctor. Customers include governments, insurance companies, moms, teachers etc. More focus should be put on delivering real value to the patient.

Forming collisions with non-traditional partners

This emerging ecosystem is attracting many new, non-traditional players, from e-health and mobile health firms to consumer electronics companies, large retailers to medical technology firms and information aggregators. These companies are rushing in to fill the gaps and capitalize on the potential returns of an outcomes-cantered world, e-health/m-health and new medical technologies companies. This includes technology, insurance, internet services, food and retailing etc.

Innovating and making use of new-technologies

Leading-edge examples include the partnership between Novartis and Proteus Biomedical, a Californian start-up, for developing a “smart-pill” technology. When one of these pills is taken, it sends wireless signals through the body to another chip worn as a skin patch. That, in turn, can upload data to a smart-phone or send it to a doctor through the internet. It ensures that the patient is taking their medication at the right time, a critical factor in successful treatments.

Bayer Diabetes Care introduced DIDGET, a blood glucose meter for children with diabetes that connects directly to Nintendo gaming systems. The DIDGET meter is designed to help young patients manage their diabetes by rewarding them for building consistent blood glucose testing habits and meeting personalized glucose target ranges. Bayer’s DIDGET meter reinforces consistent testing by awarding points that kids can use to unlock new game levels.

Focusing on prevention not only cures

The combination of longer lives, increasing susceptibility to diseases and increased standards of living leads to higher healthcare costs. One way to drive down those costs is for patients and the healthcare industry to shift their focus from treatment to prevention.

For Pharma 3.0 to be a success companies need to create long-term relationships with customers through improved customer experience. Decentralizing certain functions will allow decisions to be made faster and outsourcing certain functionalities will help to reduce costs. To succeed, companies will need to assemble capabilities they don’t currently have to build products and services that don’t yet exist. Entering into alliances in which they will join assets and capabilities to co-develop new, competitive offerings.

Healthcare spending continues and will continue to remain a top priority for most governments. A steadily growing and aging world population is expanding the potential patient base, and rising incomes in emerging countries are contributing to boost the global demand for higher-quality healthcare. Customer segments in mature markets have been expanding beyond the traditional base of physicians to include a broad range of additional customers, such as governments, insurance companies, public agencies, pharmacists, hospitals and patients.

Reference: https://www.businesslive.co.za/bd/national/health/2017-02-23-nhi-fund-to-start-operating-this-year/